At some point you’ll probably need a loan for something whether it be a holiday, car, credit card or home purchase. One of the ways a lender will assess your application is by looking at your credit history. This is why understanding what your credit report and credit score says about you is important.

What is a credit score?

Many people use the terms “credit score” and “credit report” interchangeably however they are two different things. Your credit report contains a summary of your financial history, while your credit score is included in the report and reflects how reputable your financial history is.

Credit bureaus such as Equifax hold credit report information. A credit report is created when a bank or other credit provider submits a request for information.

Why do I need a credit report?

Having a credit report and score will assist you in applying for a loan or credit card as lenders can use this as one indicator of your ability to repay. Credit reports can also be used by landlords when deciding who to rent their property to, and by employers as part of their hiring process.

How do I build a credit report?

Credit reports can be created when you have a utility account in your name and the provider runs a credit check. These include phone, gas, electricity and internet accounts. These are considered credit accounts, so if you default on payments for these, it will be listed on your credit report.

How do I access my credit report?

Visit the ASIC money smart website for a list of sites where you can access your credit report once per year for free. Be wary of websites asking you to pay for your credit report as this could be a scam. Requesting your credit report more than once per year may attract a fee from credit reporting bureaus.

What is included in your credit report?

Personal information and contact details are included. How long you’ve been at your current and previous address is also on there. Other things that make up your credit report include:

- Type of credit provider. Different lenders have different levels of risk. For example a non-traditional lender such as store finance may have a different level of risk than a bank or credit union.

- Size of credit requested. Both the type and size of the loan or credit limit you’re requesting can affect your credit score. Mortgages have a different level of risk compared to credit cards.

- Number of credit enquiries. Every time you apply for credit, the credit provider obtains a copy of your credit file and the application is noted. The pattern of credit enquiries over time also affects the level of risk. This is considered a red flag for credit providers.

- Directorship information. If you’re a director or proprietor, it may impact your score. Check both the individual and commercial sections of your credit file to see what is noted.

- Age of credit file. Check the date your credit file was created. A new file may indicate a different level of risk compared to an older file.

What stays on your credit report?

- Default information. Any personal or business credit such as overdue debts or serious credit infringements could negatively affect your score.

- Court writs. Default judgments or court writs may convey you as an increased risk and negatively impact your score.

- Bankruptcy: if you declare bankruptcy, this will stay on your report for 5 years starting from the day you declare bankruptcy or 2 years starting on the day you were no longer bankrupt.

- Debt agreement: Entering into a debt agreement is where you negotiate to pay a percentage of your combined debt that you can afford over a period of time. Payments are made to your debt agreement administrator. These agreements remain on your credit report for 5 years from when the agreement was made or 2 years from the day the agreement is completed or declared void.

What is a good credit score

Earlier on we mentioned credit bureaus hold your credit report information. They also determine your credit score differently. Generally, the higher your credit score, the better it is.

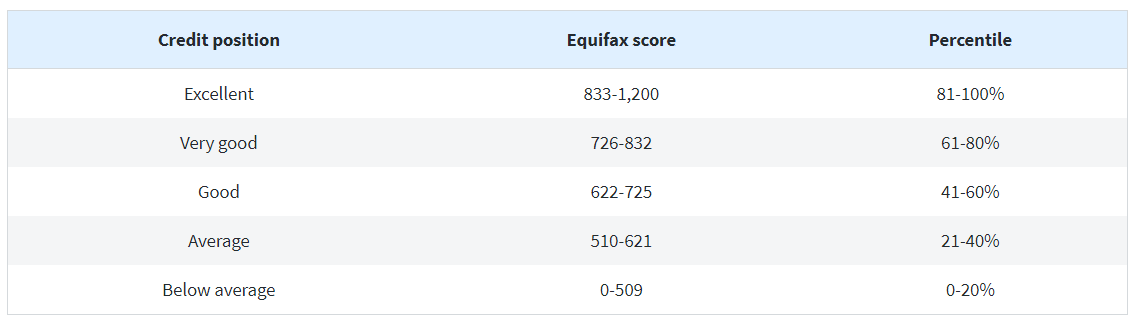

Below is a breakdown of how Equifax evaluate your credit score as an example. Looking at the table, a score between 833 and 1200 gives an excellent score which means it is less likely that a negative event (related to repaying a debt) will be recorded on your file in the next 12 months. This means you are in the top 20% of the credit-active population and will appear as less of a risk to lenders.

A below average (0-509) score means you’re in the bottom 20% of the credit-active population and are unlikely to be approved by reputable lenders.

Source: Finder.com.au Improve your credit score

Fixing issues on your credit report

When you receive your credit report, you can contact the credit bureau you received it from if there is any incorrect information. Only incorrect information can be removed. If all of the information is correct but your credit score is still low, there are steps you can take to improve your score.

How do I fix my credit score?

-

Consolidate your debts into one easily managed personal loan if possible. Consider entering into a debt agreement to pay off multiple debts. You can read more about debt agreements on the Australian Financial Security Authority’s website.

-

Lower the limit on credit cards if you are not reaching that limit with your spending.

-

Avoid a default notice by making payments within 60 days of when they are due. Default notices of $150 or more remain on your credit report for 5 years.

-

Limit the number of credit enquiries you make. Multiple enquiries for credit made within a short period are recorded on your credit report and are considered a red flag to lenders.

-

Seek help from a financial counsellor to help you work out a plan for paying down your debts, through disciplined spending and saving. Use of financial counselling services is not recorded on your credit report.

Thinking of applying for a loan or credit card, but want to know more about your credit report first? Get in touch with us today, we’re here to help.

Horizon Bank has a branch network spanning the NSW South Coast and Illawarra. Horizon Bank branch locations: Albion Park, Bega, Bermagui, Berry, Merimbula, Moruya, Nowra, Thirroul, Ulladulla & Wollongong.

The content in this article has been prepared by Horizon Bank for general information only and it is not intended to be professional advice. It does not take into account your objectives, financial situation or needs. You should seek your own legal, accounting, financial or other professional advice where appropriate, and consider the relevant Product Disclosure Statement and Terms and Conditions before deciding whether to acquire any products or services offered by Horizon Bank and/or its affiliated partners. We do not recommend any third party products or services referred to in this article unless otherwise stated and we are not liable in relation to them. Any links to third party websites are for your information and we do not endorse any content on those sites. Horizon Credit Union Ltd ABN 66 087 650 173 AFSL and Australian Credit Licence Number 240573 trading as Horizon Bank.